Cross-border payments shape your margins long before revenue hits your books. If you import inventory, pay overseas suppliers, or invoice clients in multiple currencies, small differences in exchange rates and fees compound quickly. That’s why many Canadian businesses compare Wise vs. KnightsbridgeFX when reviewing their foreign exchange setup.

Both platforms promise transparency and competitive pricing, but they serve business needs in very different ways. One prioritizes digital self-service and multi-currency accounts. The other focuses on high-value transfers, personalized support, and tighter spreads for Canadian companies making United States dollar (USD) and other major currency transactions.

This comparison breaks down how each option handles exchange rates, fees, speed, and support for B2B payments, so you can choose a solution that protects cash flow, simplifies accounting, and scales with your international operations.

Overview: Wise vs. KnightsbridgeFX at a glance

When comparing Wise vs. KnightsbridgeFX for business use, the key differences lie in how you transfer money, the amount you transfer, and the level of control you want over pricing and support. Let’s elaborate.

What Wise is best known for

Wise, formerly TransferWise, built its reputation on digital-first international money transfers and transparent pricing. It suits businesses that prefer self-serve tools and frequent, lower-value payments across multiple currencies.

Don't Waste Money With Banks.

Get Exchange Rates Up to 2% Better With KnightsbridgeFX

Wise stands out for:

- A multi-currency account that lets you hold, send, and receive United States dollar (USD), euro (EUR), British pound (GBP), and other foreign currency balances

- Online bank transfers using ACH, EFT, and local payment rails

- Clear transfer fees shown before you send money

- Showing a mid-market rate and then tacking a fee on top of the rate

- Easy setup with minimal human interaction

- Founded in Estonia with an initial focus on Europe

Wise offers efficiency for routine payments, especially when you pay international contractors or manage smaller invoices across several currencies.

What KnightsbridgeFX is best known for

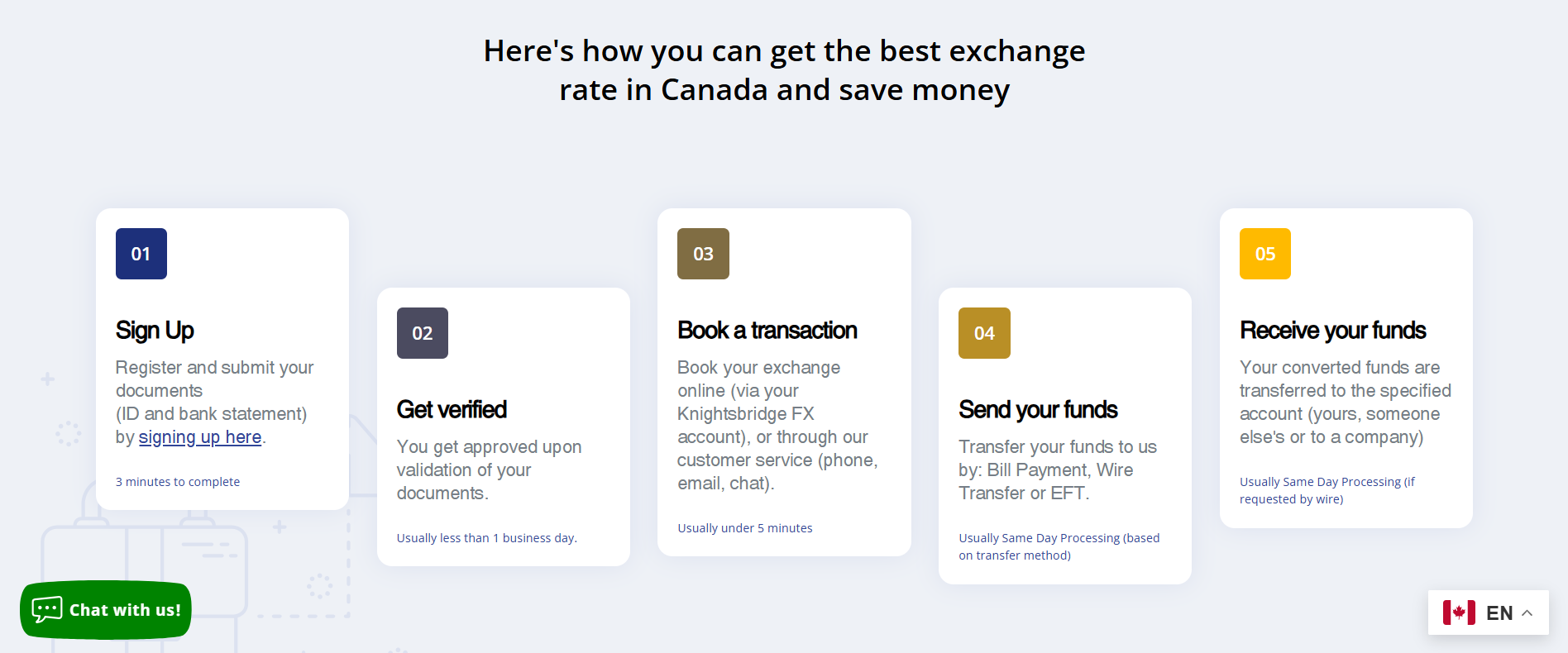

KnightsbridgeFX, a Canadian-based business, focuses on Canadian individuals and businesses that move larger amounts and want tighter control over exchange rates. It positions itself as a foreign exchange specialist rather than a general payment platform.

KnightsbridgeFX is known for:

- Competitive exchange rates with lower spreads on large USD and other major currency conversions

- No transfer fees on bank-to-bank foreign exchange transactions when using EFT

- Dedicated account managers who quote live rates, help with time conversions, and assist in how to setup a wire transfer with additional handholding

- Support for same-day or next-business-day settlements on United States dollar (USD) and Canadian dollar (CAD) transfers

- Deep experience working with Canadian banks, importers, exporters, and corporate finance teams

- Founded in Canada with Canadian support staff and intimate knowledge of the Canadian banking system and payment options

- Specialized focus on snowbird currency exchange, real estate currency exchange, and small business currency exchange

- Featured on “Dragon’s Den” in Canada and is one of Canada’s fastest-growing companies, per The Globe and Mail ranking in 2020

Knightsbridge Foreign Exchange appeals to companies where FX costs materially affect margins and predictability matters more than app-based convenience.

Key differences in business use cases

The Wise vs. KnightsbridgeFX decision becomes clearer when you map each service to real-world business needs.

Wise works best when you:

- Send frequent international payments in local currency

- Need a multi-currency account for operational flexibility

- Prioritize automation over relationship-based support

- Move smaller amounts where transfer fees matter less than speed

KnightsbridgeFX works best when you:

- Exchange large amounts of USD or other foreign currency into CAD or vice versa

- Want to reduce FX markup rather than pay visible transaction fees

- Prefer phone or email support from a named FX specialist as needed

- Need predictable pricing for supplier payments, inventory purchases, or cross-border settlements

- Prefer a Canadian-based company with Canadian support staff and need assistance working with Canadian banks and infrastructure

FX pricing structures compared: Which saves businesses more?

Comparing Wise vs. KnightsbridgeFX reveals two distinct approaches to currency exchange pricing, particularly with increasing volumes.

How Wise pricing works

Wise uses the mid-market exchange rate and adds a visible markup plus a variable transfer fee. You see the total cost before you send funds, which supports budgeting and transparency.

Key pricing elements include:

- Mid-market exchange rate with a built-in percentage markup

- Variable transfer fees that scale with transaction size

- Additional currency conversion fees when moving between balances

- Separate costs for each international money transfer

For example, if your business sends USD to overseas suppliers multiple times per month, Wise charges a fee on every transaction. At lower volumes, this structure remains competitive. As amounts grow, cumulative fees increase quickly, even though the exchange rate itself stays close to market.

How KnightsbridgeFX pricing works

KnightsbridgeFX takes a spread-based approach that removes explicit transfer fees. Instead, savings come from tighter exchange rates, particularly for USD, EUR, and GBP conversions involving Canadian dollars.

KnightsbridgeFX pricing typically includes:

- Competitive exchange rates with reduced markup on higher volumes

- No wire transfer or bank transfer fees from KnightsbridgeFX

- Rate improvement as transaction size increases

- Live quotes provided by an account manager, and transactions can be booked via portal, phone, email, or live chat on the website

Consider an import business converting USD 500,000 into Canadian dollars for inventory payments. KnightsbridgeFX often delivers meaningful savings because the spread tightens as volume increases. You avoid per-transaction fees entirely, which materially lowers total FX costs over time.

What matters most for import/export teams

Import and export teams care less about fee visibility and more about total landed cost. In a Wise vs. KnightsbridgeFX scenario:

- Wise works well for lower-volume, frequent payments with operational simplicity

- KnightsbridgeFX performs better for high-volume currency conversion where pricing flexibility matters

- FX markup matters more than transfer fees once transactions exceed five figures

- Predictable spreads help finance teams forecast costs accurately

For businesses moving significant foreign currency through Canadian banks, KnightsbridgeFX usually saves more over the long term.

Transfer speed, reliability, and settlement times

Pricing means little if payments arrive late. Importers and exporters depend on reliable settlement timelines to release shipments, meet supplier terms, and avoid penalties. Comparing Wise vs. KnightsbridgeFX highlights clear operational differences in the following ways.

How Wise processes B2B transfers

Wise relies on automated payment rails and local clearing systems to move funds internationally. Once you initiate a transfer from your Wise account, the platform routes funds through local bank transfers such as ACH, EFT, or other domestic systems.

Operational characteristics include:

- Automated processing with limited human intervention

- Settlement times that vary by currency and destination

- Transfers that typically complete within one to three business days

- Limited ability to accelerate or intervene once a transfer starts

Wise performs well for standardized international transfers, but timelines can shift due to intermediary banks or local clearing delays. Support remains primarily digital, which works best when transfers go exactly as planned.

The KnightsbridgeFX settlement flow

KnightsbridgeFX uses a more hands-on settlement model built around Canadian bank transfers and direct coordination. Once you lock in an exchange rate, KnightsbridgeFX provides a clear settlement window and executes the conversion accordingly.

The process includes:

- Rate confirmation by phone, email, or online portal

- Clear funding instructions to your Canadian bank account

- Same-day or next-business-day settlement for major currencies

- Direct communication in case of market conditions or timing changes

KnightsbridgeFX stands out for its ability to provide exact timelines quickly. That reliability reduces operational friction for teams coordinating logistics, customs clearance, and bill payment schedules.

Why reliability matters

For import/export businesses, timing failures create real costs. Late payments delay shipments. Missed settlement windows trigger supplier penalties. Inconsistent delivery complicates cash flow planning.

Because Wise mostly offers speed for routine transfers, you often get limited control. On the other hand, KnightsbridgeFX delivers reliability through human oversight and dedicated support to reduce uncertainty during high-value transactions.

When cross-border payments support core operations, reliability often outweighs convenience. For Canadian businesses moving large sums across borders, KnightsbridgeFX aligns more closely with operational reality.

Support and risk management: Human vs. self-serve

The following is a clear divide between self-serve efficiency and relationship-driven FX management.

Wise support model

Wise runs on a digital-first support structure. The platform designs its workflows to minimise human involvement, which keeps costs down and enables scale across global markets.

Wise support typically includes:

- Online help centres and FAQs for common issues

- Email-based support for transfer questions or account verification

- In-app notifications for payment status updates

- Limited phone support, often reserved for specific issues

For routine international money transfers or smaller currency conversion needs, Wise offers enough guidance to stay operational. However, when delays occur or a large USD or EUR payment faces compliance checks, response times can stretch across business days.

KnightsbridgeFX support model

KnightsbridgeFX takes the opposite approach. It assigns a real FX specialist who understands your business, transaction history, and risk exposure. That human layer reduces uncertainty at every stage of the transfer.

KnightsbridgeFX support includes:

- Direct phone and email access to a named account manager

- Customer service agents and staff based in Canada who know the Canadian banking system

- Live exchange rate quotes for large amount conversions

- Proactive updates on settlement timelines

- Immediate escalation when market volatility or banking issues arise

This model lowers operational risk for importers and exporters. If a USD payment must settle the same day to release goods, KnightsbridgeFX confirms timing up front. If market conditions shift, you receive guidance before you commit funds.

Why support matters in B2B FX

In B2B foreign exchange, mistakes scale quickly. A delayed wire transfer can stall inventory, while a pricing error can erase margin just as fast.

Wise reduces friction through automation but increases self-managed risk by placing timing, execution, and exception handling entirely on your internal team.

KnightsbridgeFX replaces automation with accountability. You work with a dedicated FX specialist who understands your transaction patterns and risk exposure, reducing uncertainty around high-value USD and foreign currency transfers.

That human oversight helps businesses save on currency exchange by avoiding rushed decisions, poorly timed conversions, and reactive transfers driven by operational pressure.

Platform experience and ease of use for business

Ease of use means different things depending on how your team operates. Comparing Wise vs. KnightsbridgeFX highlights two distinct approaches to daily FX workflows.

Wise platform strengths

Wise delivers a modern, intuitive interface designed for speed and independence. Businesses access everything through a single dashboard without speaking to anyone.

As a result, users enjoy the following advantages:

- A multi-currency account to hold USD, EUR, GBP, and other foreign currencies

- Fast setup and onboarding with minimal paperwork

- Automated bank transfers via ACH, EFT, and local payment rails

- Clear visibility into transfer fees, exchange rates, and settlement status

KnightsbridgeFX platform strengths

KnightsbridgeFX prioritises outcome over interface. The platform experience centres on execution quality rather than self-service features.

KnightsbridgeFX strengths include:

- Simple rate booking through phone, email, or website portal

- Clear funding instructions tied to Canadian bank accounts

- Minimal steps once rates lock in

- No need to manage multiple balances or internal wallets

This approach reduces cognitive load for teams handling large FX transactions. Instead of navigating dashboards, you focus on timing, pricing, and settlement certainty. That simplicity supports businesses looking to save on currency exchange without adding operational complexity.

Which is better for B2B workflows?

The right choice depends on the transaction profile in the following ways:

| Business workflow factor | Wise | KnightsbridgeFX |

| Team structure | Decentralised teams managing payments independently | Finance-led teams with central FX control |

| Typical transaction size | Low-value, frequent international transfers | High-value USD and foreign currency conversions |

| FX decision-making | Self-serve, platform-driven | Guided by an FX specialist |

| Primary optimisation | Convenience and automation | Pricing outcomes and margin protection |

| Best use case | Routine operational payments | Strategic FX for imports, exports, and supplier payments |

For Canadian businesses focused on the best way to send money Canada-wide while protecting margins, KnightsbridgeFX aligns better with B2B workflows where FX decisions carry weight.

Security, compliance, and trust factors for Canadian businesses

When you move large sums across borders, trust carries as much weight as pricing. Importers and exporters, especially those that import or export luxury goods, face heightened scrutiny, tighter timelines, and greater downside risk if payments fail.

Regulatory status for Wise

Wise operates as a regulated financial services provider in multiple jurisdictions. In Canada, Wise registers with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) as a money services business and follows local anti-money laundering and know-your-customer requirements.

From a compliance standpoint, Wise provides:

- FINTRAC registration for Canadian operations

- Safeguarded client funds held separately from operating capital

- Automated compliance checks on international transfers

- Standard reporting aligned with global financial institutions

However, compliance interactions remain largely automated. If a transfer triggers enhanced review, resolution can take multiple business days with limited escalation options.

KnightsbridgeFX regulatory status

KnightsbridgeFX operates as a Canadian foreign exchange specialist and also registers with FINTRAC. Its compliance model pairs regulatory oversight with human review, which reduces friction for complex or high-value transactions.

KnightsbridgeFX compliance strengths include:

- FINTRAC registration and Canadian regulatory alignment

- Client funds are held separately from operating accounts

- Manual review of large USD, EUR, and GBP conversions

- Clear audit trails for bank transfers and currency conversion

- Direct communication during compliance checks

This structure benefits businesses moving large amounts or operating in regulated industries. For companies that import and export goods, documentation accuracy and payment traceability matter. KnightsbridgeFX reduces risk by addressing issues in real time rather than routing them through ticket systems.

Why security and compliance matter for import/export companies

In B2B foreign exchange, payment failure carries real operational consequences. A delayed or rejected transfer can stop goods at the border, strain supplier relationships, or trigger compliance reviews at Canadian banks.

The difference between Wise and KnightsbridgeFX comes down to how issues get resolved. Wise relies on compliant, automated systems that work well at scale but offer limited human intervention when something goes wrong. KnightsbridgeFX pairs regulatory compliance with direct specialist oversight, which helps resolve questions before they become delays.

Strong compliance shortens settlement timelines, reduces payment reversals, and creates clear documentation for audits and disputes. For Canadian businesses managing high-value cross-border payments, that consistency builds trust where it matters most.

Which FX is right for your business?

The right FX partner depends on how you move money, how much you move, and how much risk you can tolerate.

When Wise is the right choice

Wise fits businesses that value speed, autonomy, and global reach over customised pricing.

Therefore, choose Wise if you:

- Send frequent international payments in smaller amounts

- Use a multi-currency account to manage operational cash flow

- Accept visible transfer fees for pricing transparency

- Prefer digital self-service over relationship-based support

When KnightsbridgeFX is the right choice

KnightsbridgeFX suits businesses where FX costs affect profitability and timing matters.

Choose KnightsbridgeFX if you:

- Prefer to work with a Canadian company with Canadian staff and expertise with Canadians and Canadian banks

- Convert large amounts of USD or foreign currency into Canadian dollars

- Want to save on currency exchange through tighter spreads

- Need predictable settlement timelines

- Import or export luxury goods or high-value inventory

- Prefer direct access to an FX specialist

How to evaluate your next transfer

Before your next transaction, run through this checklist:

- FX margin: How wide is the markup on your currency conversion?

- Fees: Do transfer fees compound as volume increases?

- Support: Can you reach a real person when timing matters?

- Timeline: Do you know the exact settlement date up front?

- Risks: Who manages delays, compliance reviews, or errors?

- Volume needs: Does pricing improve as amounts increase?

If FX plays a strategic role in your business, compare total landed cost, not just headline rates.

Get a quote from KnightsbridgeFX to compare your landed FX cost in minutes and see how much you could save.