You’d think a wire transfer would come with a simple price tag. Instead, you see a mix of wire fees, exchange rate markups, and vague “additional charges” that only show up after the money leaves your bank account.

That confusion is exactly what people encounter when they ask, “How much is a wire transfer?” and the answer rarely comes straight.

If you send money through a Canadian financial institution, especially across borders, the final cost can vary depending on the bank, the currency, the destination, and the method of payment. An international wire transfer in United States dollars (USD) can cost far more than a domestic transfer in Canadian dollars (CAD), and most banks don’t volunteer the full breakdown.

This guide strips away the guesswork. You’ll see what Canadian banks actually charge, where the hidden costs live, and how to avoid paying more than you need to move your money.

What does a wire transfer actually cost in Canada?

The true cost comes from three separate layers, including your bank’s service fee, possible intermediary charges, and foreign exchange markups if currency conversion is involved. Each one chips away at the amount sent from your bank account in the following ways.

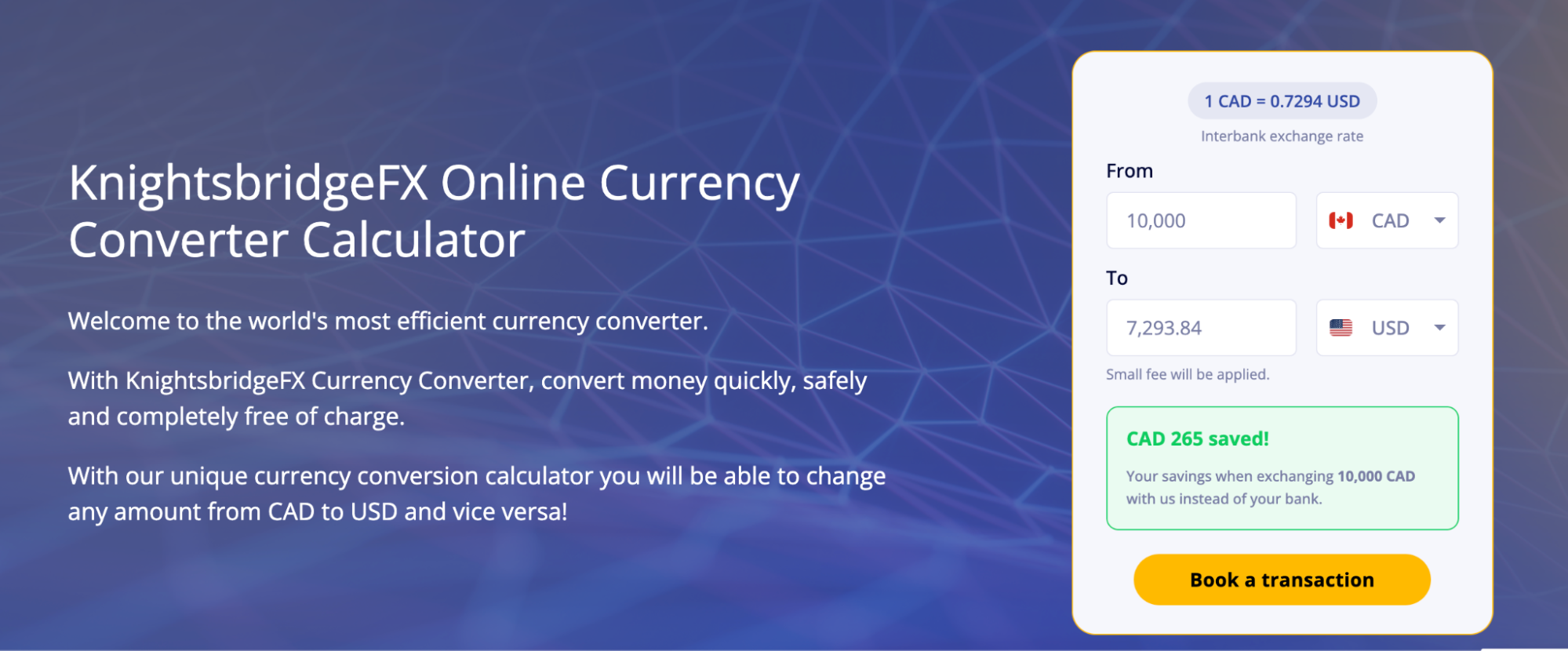

Don't Waste Money With Banks.

Get Exchange Rates Up to 2% Better With KnightsbridgeFX

Standard outgoing wire fees

Canadian banks charge different wire transfer fees depending on where the money goes and how you send it.

For a domestic wire transfer in CAD, banks typically charge between $15 and $30. These payments usually settle within one to two business days and move directly between Canadian financial institutions.

An international wire transfer costs more. Outgoing international wires often range from $30 to $80, depending on the bank, destination, and whether you send the transfer in-branch, through online banking, or via mobile banking. Sending USD or another foreign currency usually pushes fees higher, especially when the recipient’s bank sits outside Canada.

These are just the up-front service fees. They don’t reflect what happens to your money once it leaves your bank.

Intermediary bank fees

Many international wire transfers don’t move directly from sender to recipient. Instead, they pass through one or more intermediary banks before reaching the recipient’s bank account.

Each intermediary bank can deduct its own fee, often $10 to $25, from the transfer. These charges don’t appear on your receipt, and your bank rarely controls them. The result is a smaller deposit landing in the recipient’s account, even if you paid a flat wire fee up front.

This is common with cross-border transfers that rely on SWIFT codes, IBANs, or routing through major international banks. It’s one of the most frustrating parts of international money transfer pricing because neither the sender nor the recipient sees the full fee structure in advance.

FX margin markups

If your wire transfer involves currency conversion, exchange rates quietly become the most expensive part of the transaction.

Banks typically apply a foreign exchange margin of 2% to 4% on top of the mid-market rate. That markup applies whether you’re sending US dollars, euros, or another foreign currency. On a $10,000 transfer, a 3% FX margin means $300 disappears before the money even reaches the recipient.

Banks rarely describe this as a fee. It shows up as a less favourable rate compared to a real-time currency converter, making it harder to spot.

When you combine service fees, intermediary charges, and FX markups, the final answer to how much a wire transfer is often ends up far higher than expected, especially for international payments. Understanding each layer puts you in a better position to reduce costs and keep more of your money working for you.

How much do Canadian banks charge for wire transfers?

If you ask your bank how much a wire transfer is, you’ll usually get a single number. What you won’t get is the full cost picture. Canadian banks publish base wire fees, but the final amount sent and received often tells a different story once service fees, bank fees, and exchange rate markups come into play.

Typical fee ranges across major Canadian banks

Most large Canadian banks follow a similar pricing structure for outgoing wire transfers.

For domestic wire transfers in Canadian dollars (CAD), you can expect service fees between $15 and $30. These payments usually clear quickly, with wire transfer timeframes in Canada landing within one to two business days.

International wire transfers cost more. Outgoing international wires typically range from $30 to $80, depending on the financial institution and whether you send the payment in-branch or through online banking. Incoming wire transfers may also carry fees, often $15 to $20, deducted before funds reach the recipient’s account.

Banks like RBC, CIBC, and Scotiabank publish these wire fees openly. What they don’t highlight is how often the transfer also triggers FX margins, intermediary bank deductions, and additional charges tied to currency conversion.

Why businesses get surprised by the final amounts received

The shock usually comes from what isn’t listed on the fee page.

When a wire involves foreign currency, banks apply an exchange rate that includes a markup above the market rate. That margin can quietly exceed the visible wire fee itself. Add intermediary banks to the route, and each one may deduct its own transaction fees before the money reaches the recipient’s bank.

This is where many businesses lose visibility. The sender sees one fee. The recipient sees less money arrive. Somewhere in between, FX markups and third-party bank charges reduce the transfer value, without a clear breakdown.

That’s why many businesses start looking beyond traditional banks for international money transfer needs. Providers that focus on transparent pricing and sharper currency exchange Canada rates, like Canada-based KnightsbridgeFX, remove the guesswork. You see the rate, you see the cost, and you know exactly how much lands in the recipient account, no surprises after the transfer is complete.

The hidden cost that matters most: FX markups, not wire fees

Flat wire fees grab attention because they’re easy to see. The higher cost sits quietly in the exchange rate. That’s why asking how much a wire transfer is without looking at FX margins almost always leads to the wrong conclusion.

Let’s elaborate.

How a 2%–3% FX markup impacts business transactions

A 2%–3% FX markup sounds small until you apply it to real numbers. On a $25,000 USD payment converted to CAD, a 2.5% margin costs you $625, far more than the wire fee itself. The more you send money, the more that margin compounds.

This hits hardest when you move funds regularly between currencies. Even when you follow the same steps for how to send a wire transfer, the cost shifts every time the exchange rate does. Over a year, FX margins can quietly drain thousands from your operating budget.

Why most banks don’t disclose their real FX spread

Banks rarely label FX margins as fees. Instead, they build them into the exchange rate you’re offered. You won’t see a line item saying “FX markup.” You’ll just get a rate that’s worse than the market.

That lack of transparency makes it difficult to compare providers or forecast costs accurately. By the time you realize the impact, the transfer has already cleared, and the loss is locked in.

How KnightsbridgeFX lowers total transfer costs

KnightsbridgeFX tackles the cost that actually matters. Instead of hiding margins inside inflated exchange rates, you get access to highly competitive FX pricing with clear, up-front visibility.

You still make international wire transfer payments when needed, but without paying unnecessary FX markups. That means:

- Sharper exchange rates on large and small transfers

- No surprise deductions after the funds leave your account

- Predictable costs you can plan around

When FX margins shrink, the question of how much a wire transfer is suddenly has a much better answer.

Also read: KnightsbridgeFX vs OFX Review: Which Is Best?

Wire transfer costs for businesses: What actually drives your costs up?

Wire transfers become expensive when everyday business realities collide with opaque pricing and rigid banking processes. The following is how that happens.

High-volume or frequent USD/CAD transfers

If you move funds between USD and CAD often, FX margins matter more than wire fees. Repeated conversions amplify small spreads into material losses, especially when you rely on banks that apply wide markups on every transfer.

Unpredictable timing and cash-flow issues

Wire transfers don’t always settle when you expect. Delays of one or two business days can disrupt cash flow, particularly when supplier payments or payroll depend on exact timing. Uncertainty around settlement makes planning harder and often forces you to keep excess cash on hand.

Difficulty managing multiple payables across countries

Handling payables across borders means juggling different bank accounts, currencies, and recipient requirements. Each international transfer introduces new variables, intermediary banks, currency conversion, and inconsistent transaction fees, all of which inflate costs and complexity.

Trust, compliance, and documentation challenges

Businesses also carry the burden of compliance. Missing details like an incorrect account number or bank name can delay payments or trigger additional charges. Every error risks more fees, more admin time, and strained relationships with overseas partners.

When you focus only on the posted wire fee, these drivers stay hidden. When you focus on FX margins, timing, and transparency, you gain real control over what wire transfers actually cost your business.

How to reduce the cost of international wire transfers

If you only compare posted bank wire fees, you miss the biggest savings opportunities. Reducing the real answer to how much a wire transfer is comes down to controlling FX costs, timing, and routing.

Compare FX providers, not just bank wire fees

Banks focus attention on flat fees because FX margins stay buried in the rate. Compare providers based on their exchange rates, not just what banks charge to send money. A tighter FX spread often saves more than eliminating a wire fee.

Use dedicated FX payment partners for high-value transfers

For larger payments, dedicated FX specialists consistently outperform banks. They price currency exchange competitively, reduce markup, and provide clearer cost visibility, especially on recurring international payments tied to contracts or suppliers.

This is where KnightsbridgeFX stands out. You get institutional-level exchange rates, transparent pricing, and no surprise deductions after funds leave your account.

Schedule transfers strategically

FX rates fluctuate throughout the day and week. Planning transfers around known payment dates, rather than reacting at the last minute, gives you more control over rates and reduces volatility-driven costs.

Minimize intermediary bank involvement

Ask providers how they route payments. Fewer intermediary banks mean fewer unexpected deductions and faster settlement. Clean routing also lowers the risk of delays tied to missing or mismatched banking details.

How FX specialists help you save on every cross-border payment

FX specialists shift the focus from transactional fees to total cost control, where real savings sit. Here’s how.

Transparent pricing with no hidden fees

FX specialists like KnightsbridgeFX quote rates clearly and explain all charges up front. You know what leaves your account and what arrives at the recipient’s bank. This eliminates guessing and reconciliation headaches.

Better exchange rates reduce total payment costs

Sharper exchange rates consistently beat bank pricing. Even small improvements compound quickly across multiple transfers, lowering your total cost far more than trimming wire fees alone.

Faster support and communication

Dedicated FX partners offer direct access to specialists who understand your transactions. When questions come up, you deal with people who know your account, not a call queue.

Secure, compliant infrastructure

FX specialists operate within strict regulatory frameworks like the Financial Consumer Agency of Canada (FCAC) or Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). You get secure processing, proper documentation, and confidence that your cross-border payments meet compliance requirements.

How much could your business save?

Take a Canadian business sending funds in foreign currency several times a month. The posted wire fee might be $40. The FX markup hidden in the exchange rate can easily add hundreds more to each transfer. Over a year, that difference becomes material, especially for exporters paying overseas suppliers or importers settling invoices in USD.

Even a modest improvement in exchange rates changes the math. Tighter FX pricing means:

- Lower effective costs on every transfer

- More predictable cash flow across currencies

- Fewer surprises when funds reach the recipient’s account

When you strip out inflated FX margins, wire transfer costs stop eroding your margins and start becoming manageable operating expenses.

Wire transfer fees don’t have to eat into your margins

Banks vary widely in what they charge for wire payments. Some add service fees on both outgoing and incoming transfers. Others layer on additional charges through intermediary banks. But across the board, FX markups remain the biggest cost driver and the least transparent one.

That’s where working with a dedicated FX provider makes the difference. Canada-based KnightsbridgeFX focuses on what banks don’t: competitive exchange rates, clear pricing, and no hidden fees buried in the spread. You see your rate up front, understand your costs, and know exactly what lands in the recipient’s account.

If you want a clear answer to how much a wire transfer is for your business, the next step is simple. Get a free rate quote and see how much you could save by cutting FX margins out of every cross-border payment.