You rely on Wise because it’s simple, transparent, and usually cheaper than a traditional Canadian bank. But once you start sending larger amounts, managing multiple currencies, or expecting faster support, the cracks start to show. That’s when looking for a Wise alternative actually makes sense.

If you care about low FX markups, working with a Canadian-based company, predictable transfer fees, strong Canadian dollar (CAD) to United States dollar (USD) support, and access to real local account details, not every provider measures up. Some shine on exchange rates but fall short on speed. Others move money fast but quietly build margin into the rate. A few go further, offering hands-on support, no-nonsense pricing, and tools designed for Canadians moving money regularly.

This guide breaks down the top Wise alternatives with a practical lens. You’ll see where each option wins, where it costs you more than expected, and which features actually matter for your money, so you can choose confidently and get going.

Why Canadian businesses look for Wise alternatives

Canadian companies rarely leave Wise because it stops working. They leave because growth exposes its limits, which directly affect cost control, cash flow, and operational certainty. For many businesses, the tipping point is support. When issues arise, they cannot reach a real person and instead get stuck in automated workflows, creating delays and frustration when fast, human resolution is critical.

While those issues are most common, here are some other reasons Canadian businesses look for Wise alternatives.

FX markups impact landed cost and margins

Wise promotes the mid-market exchange rate, but pricing still shifts as volumes grow. Transfer fees, card conversion costs, and rounding differences beyond the initial rate add up fast when you move CAD to USD, euros (EUR), or British pounds (GBP) regularly.

Don't Waste Money With Banks.

Get Exchange Rates Up to 2% Better With KnightsbridgeFX

For businesses paying international suppliers or receiving foreign-currency revenue, even a small exchange rate markup can quietly inflate landed costs. Over time, that erosion shows up in thinner margins and less predictable forecasting, especially when currency conversion happens frequently instead of occasionally.

Volume isn’t rewarded

As transaction sizes increase, many businesses expect pricing to improve. Wise doesn’t meaningfully reward higher volumes, even when monthly international payments climb into six or seven figures. You pay largely the same per-transfer pricing as a low-volume user.

That’s a key reason finance teams start comparing Wise competitors. A stronger Wise alternative typically offers tiered FX pricing or negotiated rates that improve as volumes grow, rather than locking you into flat retail-style fees.

Limited phone support

Wise relies heavily on self-service and tickets, which works fine until something goes wrong. Phone support is not widely available unless the client is at the enterprise level. Businesses handling payroll, supplier payments, or time-sensitive international transfers often want direct phone access to a real person who understands CAD flows and Canadian bank processes. This gap alone pushes many companies toward providers that offer hands-on support and accountability.

Settlement timing uncertainty

Wise publishes estimated transfer speeds, but settlement timing can vary depending on currency pairs, payment method, and intermediary banks. That uncertainty complicates cash flow planning, especially for companies managing multiple currencies or tight payment windows.

A reliable Wise alternative offers clearer settlement expectations, faster bank-to-bank transfers, and fewer surprises, so finance teams can plan payments with confidence instead of buffers.

Not built for Canadian businesses

Wise was founded in Estonia and operates primarily on a European model. While it serves Canadian customers, its product, support structure, and payment flows aren’t designed around the specific realities of Canadian businesses.

As transaction volume and complexity increase, that mismatch becomes more obvious. Canadian companies rely on domestic banks, CAD-specific settlement processes, and predictable timing across Canadian and U.S. institutions. When issues arise, generic global support often lacks the context needed to resolve problems quickly.

This is why many businesses look for a Canada-based Wise alternative. Working with a local currency exchange means support teams in the same time zone, a clearer understanding of Canadian banking systems, and direct accountability when payments are time-sensitive.

What to look for in a Wise alternative

A strong Wise alternative should lower your total cost, reduce uncertainty, and scale cleanly as your international payments grow. These are the criteria that actually matter for Canadian businesses.

FX rate competitiveness

Headline fees rarely tell the full story. What affects your bottom line is the exchange rate you actually receive after markup. The best providers in Canadian currency exchange offer truly competitive FX pricing with minimal spread over the mid-market exchange rate, especially on high-value CAD, USD, EUR, and GBP conversions.

Transparent pricing means you can see the rate, the fee, and the final payout before you send, and there are no surprises after settlement.

Support availability and escalation paths

Email-only support works until it doesn’t. When a wire transfer is delayed or account details need verification, you need fast answers and clear escalation. A serious Wise alternative provides direct phone support, named contacts, and defined escalation paths.

That access matters when you’re moving large sums or managing time-sensitive international payments, not just occasional money transfers.

Ability to handle large transfers securely

Sending five figures is very different from sending seven. Not all money transfer services are built for high-value international transfers, even if they allow them.

So look for a provider with robust compliance processes, dedicated support for large payouts, and experience handling corporate-scale foreign exchange. Security, stability, and execution speed matter more than flashy apps as transfer sizes increase.

CAD–USD specializations

For most Canadian businesses, CAD–USD flows dominate. Payroll, supplier invoices, cross-border acquisitions, and US customer revenue all rely on efficient CAD–USD currency conversion.

A strong Wise alternative specializes in this corridor, offering tight spreads, fast settlement, and predictable pricing. That focus often makes it the best way to send money in Canada when the US is your primary counterparty.

Integration with Canadian banking rails

Smooth execution depends on how well a provider works with Canadian banks. Look for support for electronic funds transfers (EFT), domestic transfers, bill payment, and local CAD account details, not just international bank transfers.

Deep integration with Canadian banking rails reduces delays, cuts transaction fees, and simplifies reconciliation, especially when moving funds between your Canadian bank and foreign currency accounts regularly.

Top Wise alternatives in Canada for importers and exporters

For importers and exporters, choosing a Wise alternative comes down to execution. You need predictable FX costs, reliable settlement, and support that understands Canadian banking.

Here’s how the leading options compare for Canadian businesses moving money internationally.

| Provider | Best for | FX pricing approach | Support model |

| KnightsbridgeFX | High-value CAD–USD and recurring business FX | Tight spreads, low markup over mid-market rates | Direct Canadian phone support |

| OFX | Global supplier payments across many currencies | Variable spread, improves with volume | Phone and online support |

| Xe Money Transfer | Broad currency access with brand recognition | Built-in FX margin | Primarily online support |

| PayPal Business | Receiving international customer payments | High FX markup and conversion fees | Online resolution only |

| Your bank | Occasional international wires | Highest exchange rate markup | Branch, phone, and online |

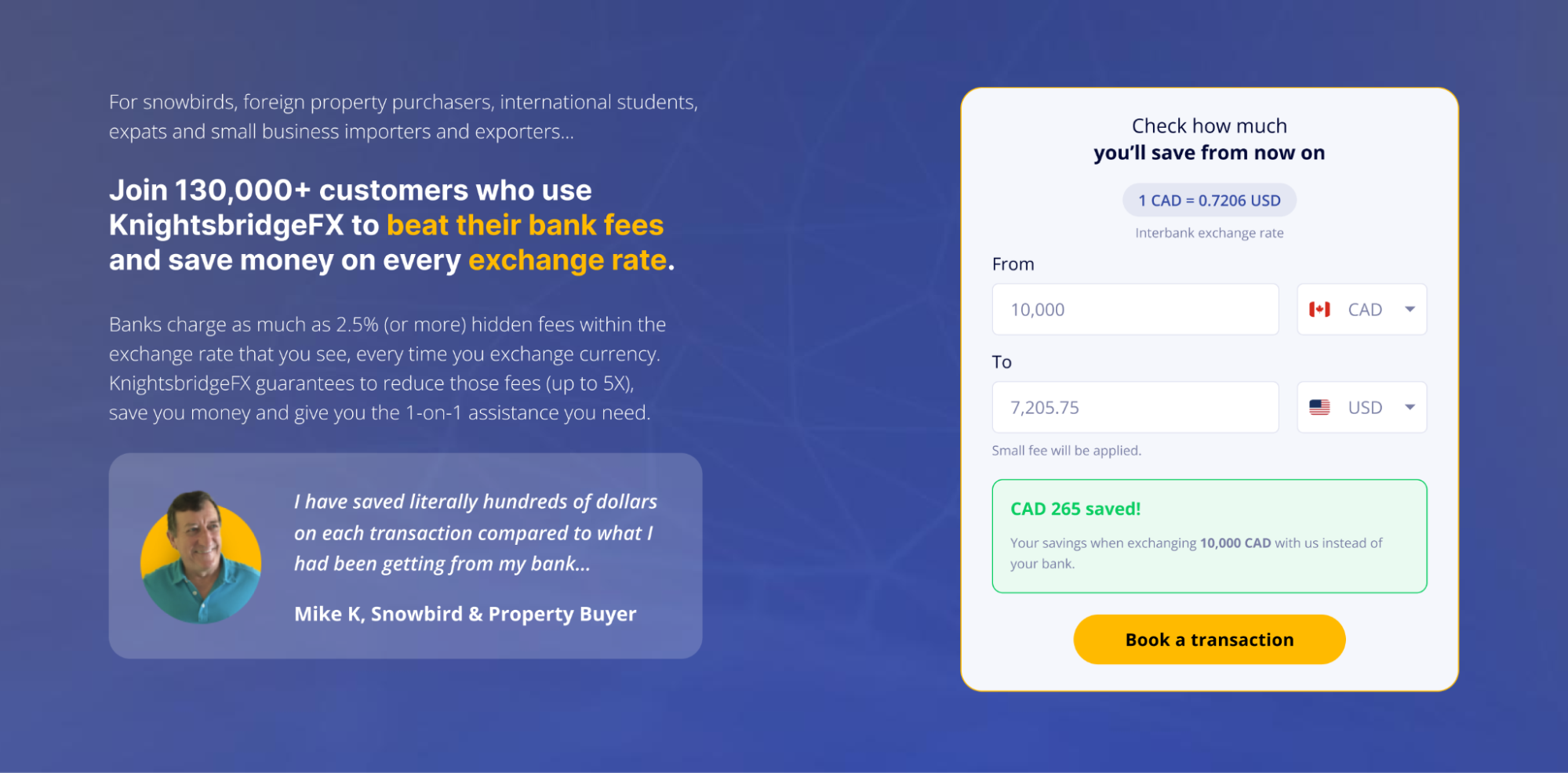

1. KnightsbridgeFX

KnightsbridgeFX is a Canada-based currency exchange founded over 15 years ago, built specifically to serve Canadian individuals and businesses. The company operates with Canadian staff and works directly with Canadian banks, allowing for clearer communication, faster resolution, and fewer surprises when moving funds across the border.

Its credibility is well established. KnightsbridgeFX was featured on “Dragons’ Den,” where multiple Dragons offered a $1 million investment. It holds an A+ rating with the Better Business Bureau and has been recognized by The Globe and Mail as one of Canada’s fastest-growing companies.

Features:

- Institutional-level FX rates: Access highly competitive exchange rates that are always better than the bank, with the ability to negotiate custom rates for higher-value or repeat transfers across CAD–USD, EUR, and GBP.

- Flexible payment methods: Accommodate EFT, bill payments, and wire transactions, so businesses can move money in the way that best fits their accounting and operational workflows.

- Dedicated phone support: Deal directly with Canadian FX specialists who manage transfers end-to-end, resolve issues quickly, and provide real human support when timing matters.

- High-value transfer expertise: Move large international payments securely with no volume caps or consumer-style limits, ensuring predictable execution for business-critical transactions.

Cons:

- The platform prioritizes execution and pricing over multi-currency wallets or debit cards.

- It’s designed for planned transfers rather than instant, on-demand micro-payments.

2. OFX

OFX positions itself as a global money transfer provider for businesses sending funds internationally at scale. It’s commonly used for recurring international payments and supplier settlements.

Features:

- No fixed transfer fees on many routes: Avoid flat fees on larger international transfers.

- Wide currency coverage: Send and receive multiple foreign currencies across global markets.

- Business-focused accounts: Get access to tools designed for recurring international payments.

Cons:

- Exchange rate competitiveness varies by volume and currency pair.

- Settlement speed can be slower than expected on certain international transfers.

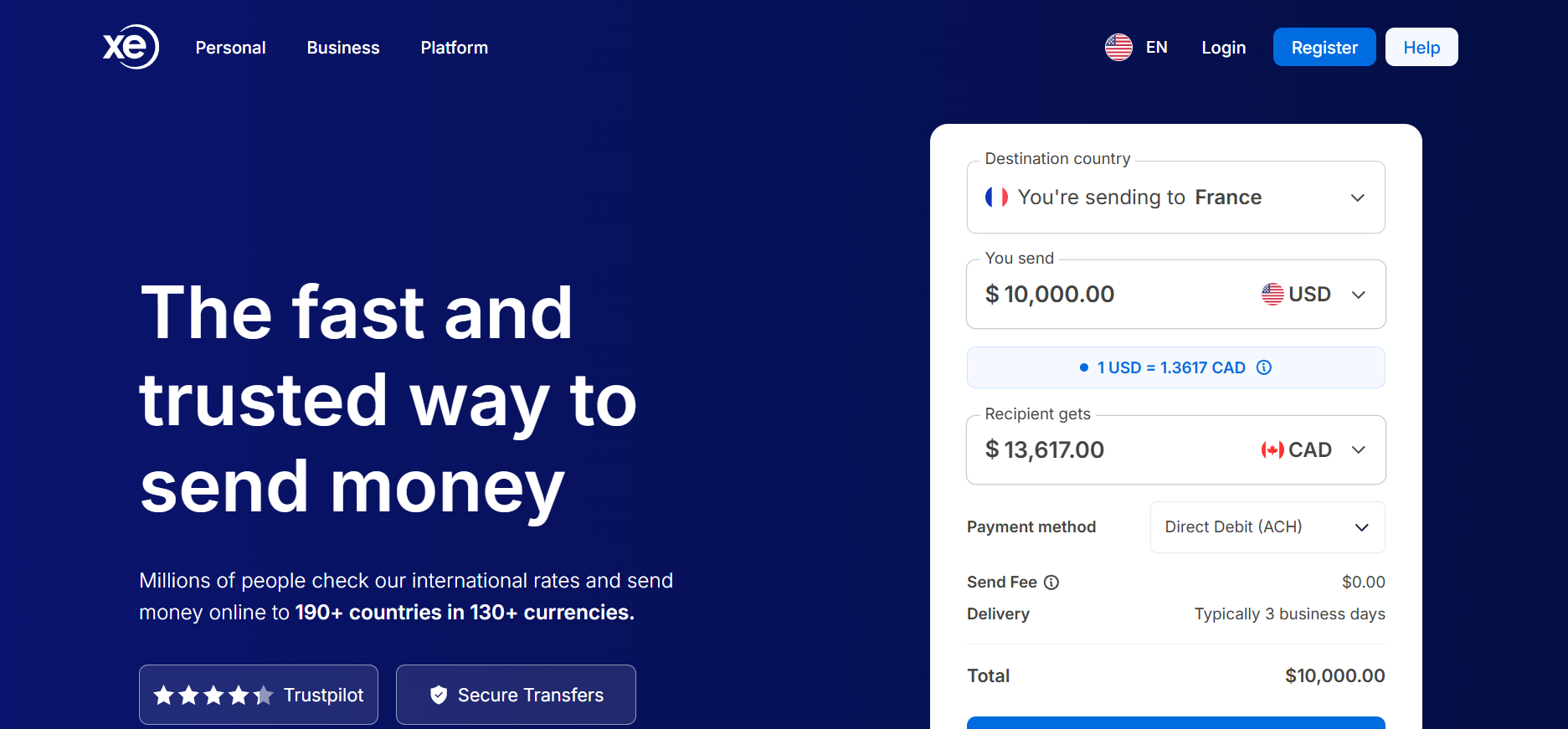

3. Xe Money Transfer

Xe is well known for its exchange rate data and offers international money transfers for businesses that prioritize brand familiarity and broad currency access.

Features:

- Global currency reach: Send money in a wide range of different currencies.

- Rate transparency: See exchange rates clearly before confirming transfers.

- Established FX brand: Benefit from a long-standing presence in foreign exchange.

Cons:

- FX spreads may be less competitive for high-value CAD–USD transfers.

- Support is more transactional than relationship-driven for businesses.

4. PayPal Business

PayPal Business is often used for receiving international payments rather than optimizing FX. It suits exporters who already invoice customers through PayPal and want simple access to global buyers.

Features:

- Fast international payouts: Receive funds quickly from global customers.

- Multiple payment methods: Accept credit cards and local payment options in many regions.

- Easy integration: Plug into existing e-commerce and invoicing systems.

Cons:

- Currency conversion fees and FX markups are high compared to FX specialists.

- Limited control over exchange rates and settlement timing.

5. Your Canadian bank

Most Canadian banks offer international wire transfers and foreign exchange services, making them the default option for many businesses, at least initially.

Features:

- Direct account integration: Transfer straight from your Canadian bank account.

- Familiar processes: Work within systems your finance team already knows.

- In-branch availability: Access support in person if needed.

Cons:

- Bank exchange rate markup and transaction fees are often the highest on the market.

- International payments can be slow, opaque, and costly for frequent transfers.

KnightsbridgeFX vs. Wise: a side-by-side comparison

For Canadian businesses moving meaningful volumes, this side-by-side comparison highlights where each provider fits and where a Wise alternative like KnightsbridgeFX delivers more control, predictability, and long-term value.

| What matters to your business | KnightsbridgeFX | Wise |

| Rates | Consistently tight spreads with no hidden exchange rate markup—KnightsbridgeFX guarantees the best exchange rates for Canadian clients moving large sums | Uses the mid-market rate but layers on transfer and conversion fees that scale with volume |

| Support | Direct phone access to Canadian FX specialists who manage your transfers end-to-end | Primarily ticket-based and self-serve support |

| Payment predictability | Quoted rates and timelines are clear before you send, making cash flow planning easier | Estimates vary by currency pair, payment method, and intermediary banks |

| Settlement speed | Optimized for CAD–USD and major corridors with fewer delays | Speed varies, especially on higher-value international transfers |

| Regulation | FINTRAC-registered and purpose-built for Canadian businesses | Regulated globally, but not Canada-first in execution |

| Security | High-value transfer controls designed for six- and seven-figure transactions | Secure for consumer and SMB use, less tailored for large volumes |

Pricing breakdown: How much can businesses save by switching?

The real cost difference between Wise and a Wise alternative shows up as volumes grow. Small markups compound quickly in the following ways:

- FX spread impact: A 0.3%–0.6% difference in exchange rate markup on CAD–USD transfers can translate into tens of thousands of dollars annually at higher volumes.

- Flat vs. scalable pricing: Wise pricing stays largely flat as volume increases, while KnightsbridgeFX pricing improves as your transfer size grows.

- Transfer fees: Per-transaction fees matter less than total FX cost, especially for importers and exporters moving money weekly.

- Forecasting accuracy: Predictable rates reduce the need for pricing buffers and protect margins.

Businesses switching often cite savings as the deciding factor, reinforced by consistently strong KnightsbridgeFX reviews that highlight pricing transparency and real support. Over time, those incremental savings turn into a measurable competitive advantage.

How to choose the right Wise alternative for your business

The right Wise alternative depends on how you move money, how often you do it, and how much uncertainty you’re willing to absorb.

Consider your monthly FX volume

If you occasionally send or receive foreign currency, most providers appear similar. Once monthly transfers reach six figures, pricing structures diverge rapidly. Flat retail-style pricing becomes expensive, and small FX spreads turn into real dollars.

One of the most reliable ways to save money on currency exchange is choosing a provider that rewards higher volumes with better rates instead of locking you into consumer pricing.

Look at your core corridor

Most Canadian businesses rely heavily on CAD–USD flows. Some also work regularly with EUR or GBP. Your primary corridor should drive your decision. A provider that specializes in your most-used currency pair will offer tighter spreads, faster settlement, and more predictable payouts.

Generalist platforms that cover dozens of currencies often underperform where Canadian businesses actually transact the most.

Determine support needs

Support matters more as transfer size and urgency increase. If a delayed international payment could affect payroll, supplier relationships, or cash flow, ticket-based help desks create risk.

Look for direct phone access, named contacts, and clear escalation paths. Businesses switching providers often point to support quality as the most immediate operational upgrade.

Evaluate contract terms and transparency

Transparency protects you in the long term. Review how exchange rates are quoted, where markup appears, and whether pricing changes with volume. Avoid providers that rely on complex fee structures or vague rate disclosures. Clear terms make forecasting easier and prevent FX from becoming a hidden cost centre.

Why KnightsbridgeFX fits this framework

KnightsbridgeFX is designed around how Canadian businesses actually move money. You get custom business pricing that improves with volume, one-on-one phone support from Canadian FX specialists, and a fast setup that makes migration straightforward.

For companies treating foreign exchange as a strategic cost, not a convenience feature, KnightsbridgeFX consistently stands out as the practical, scalable alternative.

Get a customized FX rate quote for your business

If Wise no longer fits the way you move money, switching doesn’t have to be complicated. A strong Wise alternative should lower your FX costs, improve payment predictability, and give you direct access to people who understand Canadian banking and cross-border payments.

KnightsbridgeFX helps Canadian businesses reduce exchange rate markup, move large transfers securely, and get clear answers fast. You receive custom pricing based on your volume, one-on-one support from Canadian FX specialists, and a setup process designed for easy migration.

Speak with a KnightsbridgeFX specialist today to see your real exchange rate and how much you could save on your next transfer.